Renting a Home in Romania 2025 | BLISS Imobiliare Practical & Legal Guide

29 October 2025 • Real estate

Renting a Home in Romania: A Practical and Legal Guide (2025 Edition)

Renting a home in Romania can be a smooth and rewarding experience when you understand how the process works — from negotiation and registration to taxation and legal termination rights. Whether you are an expatriate, investor, or corporate tenant, knowing the local legal and fiscal framework helps you rent safely and confidently.

At BLISS IMOBILIARE, we have over 15 years of experience helping clients navigate every aspect of renting in Romania — ensuring clarity, compliance, and peace of mind.

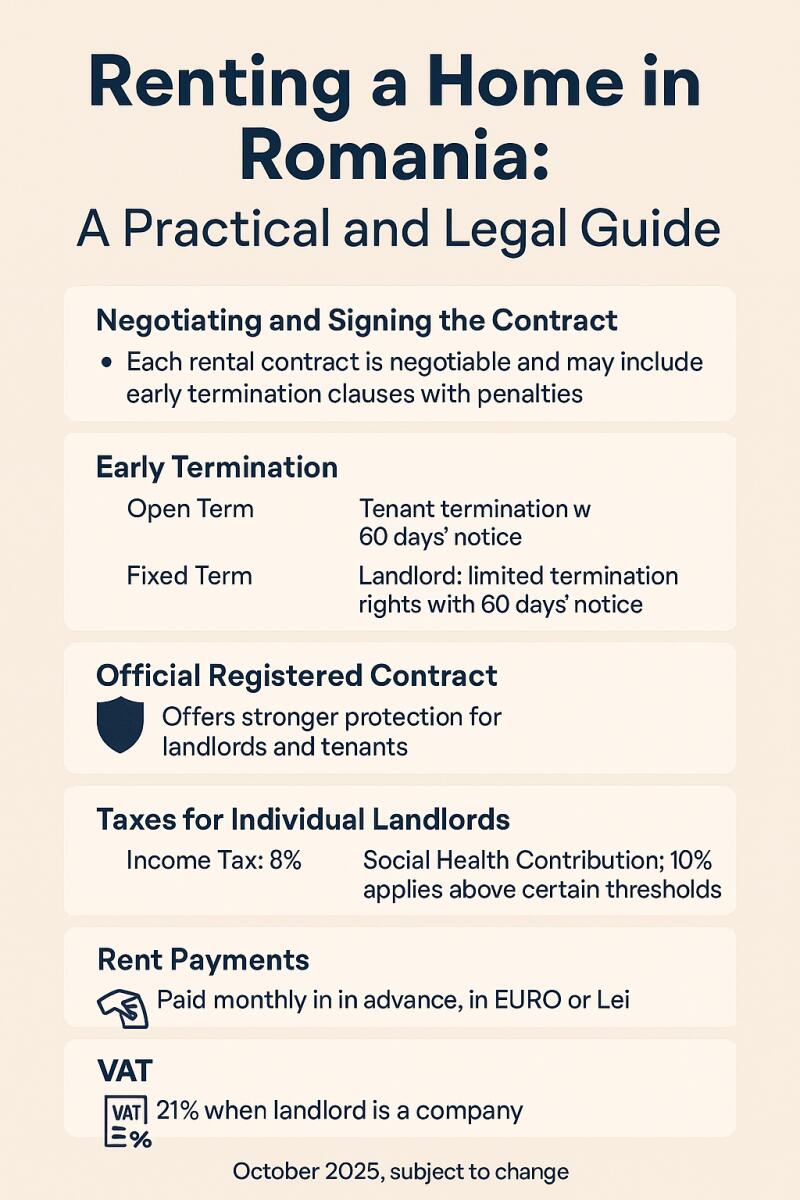

1. Negotiating and Signing the Rental Contract

Each rental contract in Romania is negotiable between the landlord and the tenant. Duration, notice period, renewal, maintenance, and termination clauses can be adapted to both parties’ needs.

Contracts usually include early termination clauses that define the conditions and penalties applicable if one party ends the agreement before the agreed term — typically 6 to 12 months. While the Romanian Civil Code provides basic rights to termination, contractual penalties can still apply if both parties have agreed to them in writing.

2. Early Termination According to the Romanian Civil Code

The Romanian Civil Code distinguishes between contracts with a fixed term and those with an open term.

Open-term contracts:

- Either party may terminate the lease by sending a written notice to the other party.

- The notice period must comply with the law or local practice, usually 60 days.

Fixed-term contracts:

- The tenant may unilaterally terminate the contract with at least 60 days’ notice, without justification (Article 1825). Any clause restricting this right is null and void.

- The landlord may terminate only under limited conditions, such as personal or family housing needs, with a minimum 60-day notice (Article 1824 § 2).

- Termination due to breach (Article 1830) applies when one party fails to meet its obligations — such as non-payment of rent or damage to the property.

Although these rights are defined by law, additional penalties or compensation clauses may still apply if clearly stated in the contract.

3. The Importance of an Official Registered Contract

An increasing number of landlords now register their rental contracts with ANAF, the Romanian Tax Authority, as this offers stronger protection against non-paying or problematic tenants and ensures contracts are legally enforceable.

At BLISS IMOBILIARE, we always recommend signing and registering an official contract for the full agreed amount.

Some landlords may suggest informal agreements or recording a lower rent to avoid taxes. Please note that such practices constitute tax evasion and money laundering, and all parties involved — including tenants — can be held legally responsible.

A registered contract provides transparency, legal protection, and is often required by banks, embassies, or immigration authorities for residence purposes.

4. Rent Payments, Currency, and Exchange Rates

Rent is typically paid monthly in advance, in EURO or Lei (RON) as negotiated.

When paying in Lei, the applied rate is usually the BNR (National Bank of Romania) daily exchange rate (www.bnr.ro) or the rate used by the landlord’s bank, sometimes with a small margin to cover currency fluctuations.

This must be clearly specified in the contract.

5. VAT and Fiscal Invoicing

When the landlord is a company, a fiscal invoice is issued monthly for rent and related costs.

In such cases, VAT (21%) may apply, depending on the landlord’s registration status. For VAT-registered tenants, this tax is typically deductible.

When the landlord is a private individual, no invoices are issued. The rental contract itself is the legal payment basis and is registered with the tax authorities.

6. Security Deposit

A security deposit — generally one or two months’ rent — is required before moving in. It is refundable at the end of the lease if no damages or unpaid amounts exist. The contract should clearly define the deposit amount and return conditions.

7. Taxes for Individual Landlords (as of October 2025)

Private landlords in Romania must pay two main taxes on rental income:

1. Income Tax (Impozitul pe venit din chirii)

- Tax rate 10% with a 20% deductible allowance → effective 8% on gross income.

2. Social Health Contribution (CASS)

- Applies only when annual net income exceeds:

- 6 minimum wages (24,300 lei) → CASS 2,430 lei

- 12 minimum wages (48,600 lei) → CASS 4,860 lei

- 24 minimum wages (97,200 lei) → CASS 9,720 lei

- CASS is a 10% contribution funding Romania’s public health system. Other non-salary incomes (dividends, investments, etc.) are included cumulatively.

8. Why Work with BLISS IMOBILIARE

With deep market knowledge and a strong reputation for integrity, BLISS IMOBILIARE assists both individuals and companies in renting, buying, and relocating across Romania.

Our team manages every step — from property selection and negotiation to contract review and move-in coordination — ensuring a transparent, compliant, and stress-free process.

BLISS IMOBILIARE — Your trusted real-estate partner in Romania.

9. Disclaimer and Validity of Information

This BLISS Imobiliare Practical and Legal Guide is purely informative and reflects the situation as of October 2025.

The legal, fiscal, and real-estate framework in Romania is subject to change due to new legislation or market volatility.

For the most accurate and updated information, always consult a qualified legal or fiscal specialist before signing or negotiating any contract.