Victoria Center Acquired by Lebanese Investors | Major Bucharest Deal

26 February 2025 • Investitii

Major Transaction: Victoria Center Acquired by Lebanese Investors

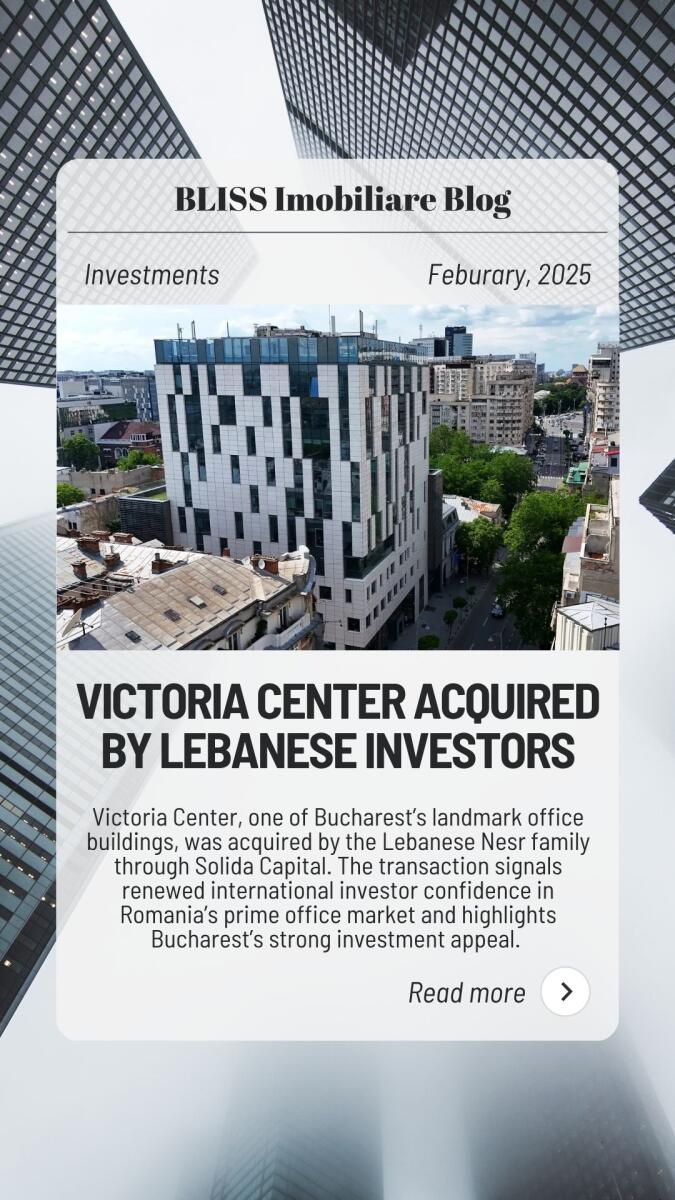

The Romanian real estate market marks another important milestone on the international investment map with the acquisition of Victoria Center, the landmark office building on Calea Victoriei, by the Lebanese Nesr family, through Solida Capital.

This deal, one of the few income-producing office asset transactions in Bucharest in recent years, sends a strong signal: Romania remains attractive to foreign capital, and prime assets continue to draw institutional investors’ attention.

Strategically located on Calea Victoriei – one of Bucharest’s most prestigious boulevards – Victoria Center stands as more than an office building; it is a symbol of the city’s modern business landscape. With excellent visibility, proximity to governmental institutions, luxury hotels, fine dining, and key commercial zones, the property offers stability, flexibility, and long-term value for any investment portfolio.

The sale process was facilitated by iO Partners, a real estate consultancy with a strong presence across Central and Eastern Europe, and Manova Partners, an active asset manager on the Romanian market. Their role was instrumental in structuring the deal, repositioning the property as a competitive asset, and managing negotiations between the parties involved.

This collaboration reflects a clear trend: major Romanian transactions are being executed at international standards, with specialized capital markets advisors ensuring transparency and efficiency.

Beyond its immediate financial dimension, this acquisition stands as a benchmark for confidence and resilience in a European context marked by caution and market correction. The fact that international investors continue to target Bucharest for prime office assets highlights both the city’s strength and growth potential.

Key takeaways for the market:

- Renewed investor confidence – International capital views Romania as a safe and profitable destination.

- Focus on prime assets – Central locations with solid tenants remain highly sought-after.

- Benchmark effect – The Victoria Center transaction will influence pricing and yields for comparable assets.

- Encouragement for developers – Well-conceived, professionally managed projects will always attract global attention.

Ultimately, Victoria Center is more than a successful investment — it is a symbol of a maturing Romanian real estate market. At a time when the office sector is redefining itself, prime properties with excellent locations and professional management continue to prove their enduring value.

The message is clear: the acquisition by Solida Capital is not just a single investment, but a step forward in consolidating Romania’s image as a regional hub for institutional real estate investment. Bucharest stands ready to compete with other European capitals — and to welcome global capital into its landmark projects.

Tranzacție majoră: Victoria Center trece la investitori libanezi