Explore premium land for sale in Bucharest-Ilfov. Ideal for real estate development or investment. Secure your future with BLISS Consulting. | BLISS Consulting Continue reading 6 listings Save

Invest in High-Value Land in Bucharest-Ilfov

6 listingsYou can also save properties to favorites by clicking on the heart icon.

ID: 906059

- 14 October 2025

ID: 906059

- 14 October 2025

For sale land 1,057 m²

Polona, Bucharest

804 EUR / m²

- CUT 2 (402 EUR / m²)

- POT 50% (529 m²)

ID: 906247

- 9 September 2025

ID: 906247

- 9 September 2025

For sale land 3,000 m²

Popasului | Padurea Cretuleasca | Matei Millo, Bucharest / Ilfov

270 EUR / m²

ID: 906248

- 26 August 2025

ID: 906248

- 26 August 2025

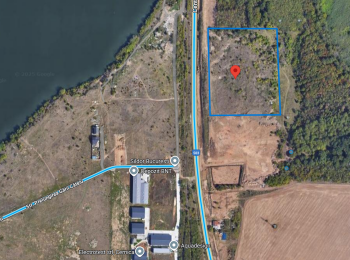

For sale land 4,965 m²

Pipera Nord, Bucharest / Ilfov

675 EUR / m²

- CUT 1.5 (466 EUR / m²)

- POT 40% (1,986 m²)

ID: 906244

- 18 February 2026

ID: 906244

- 18 February 2026

For sale land 24,800 m²

Industriilor, Bucharest

80 EUR / m²

- POT 46% (11,408 m²)

Bucharest-Ilfov: The Fastest Growing Real Estate Market

Infrastructure and Development Projects Driving Value Growth

When you wish to have a reliable partner who assists you during the selling process and you consider to work with a professional real estate agency you can call us at +40 729 005 624 or send us a message.You may also list your property HERE . Listing your property is free and you will benefit, as many others already do, of the BLISS Imobiliare reach in the market.

Invest in High-Value Land in Bucharest-Ilfov

The Bucharest-Ilfov region is a top destination for real estate investors looking for profitable land acquisition opportunities. Whether for residential or commercial development, infrastructure projects, or long-term speculation, land prices in this area continue to rise due to increasing demand, strategic location, and favorable legislation.

Why Now is the Best Time to Invest in Land in Bucharest-Ilfov

The Romanian real estate market is evolving rapidly, making land acquisition a smart financial move. Key reasons to invest now include:

- Urban Expansion: The continuous growth of Bucharest and its metropolitan area creates strong demand for development land.

- Market Appreciation: Land values in Ilfov have seen consistent annual increases, ensuring profitable returns.

- Legislation Support: Romanian property laws provide secure ownership rights and facilitate real estate investments.

The Benefits of Buying Land for Development or Speculation

Investing in land offers multiple advantages:

- Development Potential: Land in Bucharest-Ilfov is ideal for housing projects, commercial buildings, and logistics centers.

- Lower Maintenance Costs: Compared to built properties, land has minimal upkeep expenses.

- High ROI: With market growth, well-positioned land can double in value over time.

Why Choose BLISS Consulting for Your Land Investment?

BLISS Consulting is a leading real estate advisory firm specializing in land transactions in Bucharest and Ilfov. Our services include:

- Market Research & Investment Analysis: Identify the best land opportunities based on growth trends.

- Legal & Administrative Support: Assistance with property titles, zoning regulations, and transaction security.

- Strategic Advisory: Tailored solutions for developers, investors, and private buyers.

Secure your investment today with professional guidance from BLISS Consulting. Contact us for a customized consultation and the best land offers in Bucharest-Ilfov.